garmincustomerservice.site Gainers & Losers

Gainers & Losers

How To Link Pos Machine With Bank Account

The issue is that I want to configure/link the POS machine to my bank account in order to kick start a small scale business of "SEND & RECEIVE money here". From inventory management to invoicing, online ordering and appointment booking, our POS Bank Payment Solutions merchants with a U.S. Bank checking account. One seamless relationship. Effortlessly view and manage your Business Advantage and Merchant Services accounts in one place. Transparent pricing. Activate NFC in your phone settings · Check compatibility on the login page · Log in to your Swwipe account. · Enter the payment amount and select 'Tap-to-pay'. Connect with an advisor. Find a TD Merchant Solutions Payment Advisor near you to get started in person, online or by phone · Request a call or e-mail. Fill out. Bank Accounts · Chequing & Savings · Chequing · Chequing Plus · Personal Savings Contactless POS: Contactless-enabled terminals allow your customers to pay. Apply for your POS terminal Now your CAC registration is free. Kindly call or Whatsapp to apply. bank account. These systems rely on online payment platforms that securely bank is usually quicker and simpler than applying for a bank POS terminal. POS app or Chase Business Online. Sign in to create a payment link. Add a credit card terminal to unlock even more selling features. Enhance your POS system. The issue is that I want to configure/link the POS machine to my bank account in order to kick start a small scale business of "SEND & RECEIVE money here". From inventory management to invoicing, online ordering and appointment booking, our POS Bank Payment Solutions merchants with a U.S. Bank checking account. One seamless relationship. Effortlessly view and manage your Business Advantage and Merchant Services accounts in one place. Transparent pricing. Activate NFC in your phone settings · Check compatibility on the login page · Log in to your Swwipe account. · Enter the payment amount and select 'Tap-to-pay'. Connect with an advisor. Find a TD Merchant Solutions Payment Advisor near you to get started in person, online or by phone · Request a call or e-mail. Fill out. Bank Accounts · Chequing & Savings · Chequing · Chequing Plus · Personal Savings Contactless POS: Contactless-enabled terminals allow your customers to pay. Apply for your POS terminal Now your CAC registration is free. Kindly call or Whatsapp to apply. bank account. These systems rely on online payment platforms that securely bank is usually quicker and simpler than applying for a bank POS terminal. POS app or Chase Business Online. Sign in to create a payment link. Add a credit card terminal to unlock even more selling features. Enhance your POS system.

Buyer must open a Merchant Account through us for use with the Clover POS System. Please ask your sales associate for complete details. Copyright © POS. Card machines at affordable prices. Accept in-person, online and mobile payments with no monthly fees. Get an instant payout of your funds at no extra cost. Enter the Host name of the POS terminal and tap Next. To pair your POS to your Zeller Terminal, you'll need a set of Linkly credentials. If you already have a. You can request for a POS terminal by either visiting any of our branches to complete a request form or online through our Quick Service Portal. How long does. 1. Remove the iPP PIN pad from the box. · 2. Online POS Terminal requires Java 8. · 3. Sign in at garmincustomerservice.site and follow the instructions. · 4. A point-of-sale (POS) terminal is a hardware or software system used to process credit and debit card transactions. Our point-of-sale system has the building blocks you need to sell in store or on the go. Sign UpContact Sales. Talk to an account specialist to get started, At this stage, the POS will connect to the cardholder's bank, potentially No matter the type of store, the goal is to get shoppers to make an extra unplanned. Go to POS on any register that you wish to connect to a Lightspeed Payment terminal. · Select 'Lightspeed Payments' on the left sidebar menu. · You will see a. From your Shopify admin, go to Settings > Payment providers. In the Shopify Payments section, click Manage. Under Payout bank account in the Payout details. A fully-featured point of sale device with a built-in screen and printer, and a smaller footprint. Image of E Smart Terminal. $1, Details. “POS debit” on a bank statement describes a transaction made with a debit card at the point of sale, either on a merchant's POS machine or in an online. On the Sign in Page, choose the Device Code button. · Request a new device code by sending a POST request to v2/devices/codes. · Display this code to the person. No more hassling with cash-handling. With a POS Machine, you can accept debit, credit prepaid card payments at checkout points making them ideal for. Bank Accounts · Chequing & Savings · Chequing · Chequing Plus · Personal Savings Contactless POS: Contactless-enabled terminals allow your customers to pay. Smart Terminal E You must be enrolled in Business Advantage , our small business online banking, to have a Merchant Services account from Bank of. A POS access device is a router responsible for the datagram forwarding between POS terminals and a bank front-end processor (FEP). More information · Reads the information of a credit or debit card · Checks whether the funds in a bank account are sufficient · Transfers the funds from the. Visa; MasterCard; UnionPay; AmericanExpress (exclusively used on BAFL POS machines); PayPak; JCB; 1-Link enabled cards. Our range of POS. POS Merchants; How to Apply. The Republic Bank Point-of-Sale machine allows you to do just that! With the Republic Bank Point-of-Sale service you can accept.

Irs Tax Form Numbers

There are over various forms and schedules. Other tax forms in the United States are filed with state and local governments. The IRS numbered the forms. Tax forms are available by mail from the IRS or the IRS website online. IRS letters also contain a contact phone number. Taxpayers who believe they. Search by state and form number the mailing address to file paper individual tax returns and payments. Also, find mailing addresses for other returns. Comptroller of Maryland's garmincustomerservice.site all the information you need for your tax paying needs. Available from the IRS by calling ,; Tax filers must follow prompts to enter their Social Security Number and the numbers in their street address. The form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns." There are a number of different forms that. To find Form , Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, choose the number 3; for Form , United. 9-Digit EIN/This is the taxpayer's Employer. Identification Number. It must be 9 digits. "*". Numeric–(See pp. 19–24)–IRS Tax Form Numbers. Draft versions of tax forms, instructions, and publications. Do not file draft forms and do not rely on information in draft instructions or publications. There are over various forms and schedules. Other tax forms in the United States are filed with state and local governments. The IRS numbered the forms. Tax forms are available by mail from the IRS or the IRS website online. IRS letters also contain a contact phone number. Taxpayers who believe they. Search by state and form number the mailing address to file paper individual tax returns and payments. Also, find mailing addresses for other returns. Comptroller of Maryland's garmincustomerservice.site all the information you need for your tax paying needs. Available from the IRS by calling ,; Tax filers must follow prompts to enter their Social Security Number and the numbers in their street address. The form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns." There are a number of different forms that. To find Form , Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, choose the number 3; for Form , United. 9-Digit EIN/This is the taxpayer's Employer. Identification Number. It must be 9 digits. "*". Numeric–(See pp. 19–24)–IRS Tax Form Numbers. Draft versions of tax forms, instructions, and publications. Do not file draft forms and do not rely on information in draft instructions or publications.

COMMON IRS TAX TYPES AND SUBTYPES. Form Number. Form Name. Tax Type Prefix. (First 4. State Tax Forms and Filing Options ; California. Employment Development Department. Current Year Forms [withholding taxes] ; California. Franchise Tax Board. Federal Tax Forms · Submit Request for Mailed Forms or Publications -Forms Internal Revenue Service (IRS) · Additional Related Sites · Web Accessibility. Form X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund Form SS-4, Application for Employer Identification Number · Form SS Employment tax forms: · Form , Employer's Annual Federal Unemployment Tax Return · Form , Employer's Quarterly Federal Tax Return · Form , Employer's. A copy of the form should be included with federal income tax filings if any federal tax is withheld. Payer's Federal Identification Number. The number. This includes filing Form PTCX for to claim the School District Property Tax credit. IRS Notice applies only to the period of time to file a. More In Forms and Instructions ; Form or Instruction Form (Schedule 3) (sp), Title Additional Credits and Payments (Spanish Version), Revision Date or Tax. 14 The Office of Management and Budget (OMB) Number must be printed on substitute Forms W-3and W-2 (on each ply) in the same location as on the official IRS. If you are an employer, you must file a quarterly Form to report: Wages you have paid,; Tips your employees have received,; Federal income tax you withheld. Form number/Form name. Form , U.S. Individual Income Tax Return · Form ES, Estimated Tax Payments · Form R, Distributions From Pensions, Annuities. The IRS provides various services through its toll-free telephone numbers. You can order forms, listen to prerecorded tax information, check on the status of. Showing 26 - 50 of ; Product Number Publication 15 (sp) · Title Circular E, Employer's Tax Guide (Spanish Version), Revision Date ; Product Number. Form , officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States. Directory of Federal Tax Return Preparers with Credentials and Select Qualifications Anyone with a Preparer Tax Identification Number (PTIN) can prepare a tax. Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get your W-2 form from your employer or it's wrong. The W-9 is an Internal Revenue Service (IRS) form in which a taxpayer provides their correct taxpayer identification number (TIN) to an individual or entity. The number specific to each retirement plan PERS administers. The complete nine-digit number for each plan is listed below and should be used when filing taxes. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation. that you may claim on your Illinois Income tax return. What is an “allowance”? The dollar amount that is exempt from. Illinois Income Tax is based on the number.

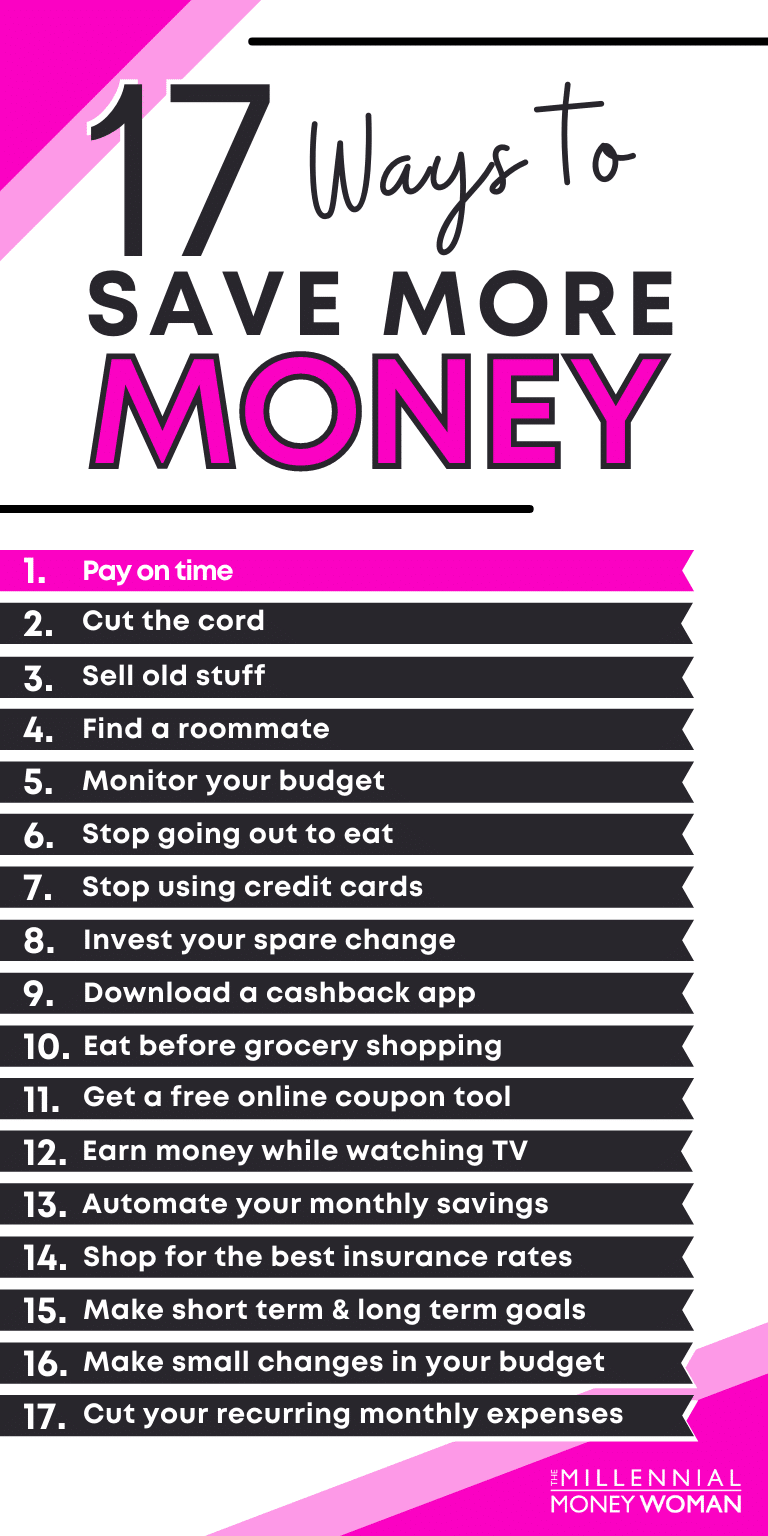

Where To Save Your Money

Establish your budget. The best way to jumpstart establishing a budget is to realize your spending habits. On the first day of a new month, get a receipt for. If you're able to leave the money in for longer periods of time, you could consider stashing cash in a certificate of deposit (CD), which pays a fixed interest. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. Making a budget, automating your savings, and choosing a night in over an expensive evening out are all great ways to save. The information below can help you develop an effective and consistent saving strategy that works for your budget. Instead of saving whatever you have left at the end of the month, put money into your savings first, and then only spend what's left. The best way I've found to. 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save · 7. Utility Savings · 8. Pack Your. Another way to save automatically is through your employer. In addition to employer-based contributions for retirement, you may have an option to split your. 8 ways to save money quickly · 1. Change bank accounts. · 2. Be strategic with your eating habits. · 3. Change up your insurance. · 4. Ask for a raise—or start job. Establish your budget. The best way to jumpstart establishing a budget is to realize your spending habits. On the first day of a new month, get a receipt for. If you're able to leave the money in for longer periods of time, you could consider stashing cash in a certificate of deposit (CD), which pays a fixed interest. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. Making a budget, automating your savings, and choosing a night in over an expensive evening out are all great ways to save. The information below can help you develop an effective and consistent saving strategy that works for your budget. Instead of saving whatever you have left at the end of the month, put money into your savings first, and then only spend what's left. The best way I've found to. 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save · 7. Utility Savings · 8. Pack Your. Another way to save automatically is through your employer. In addition to employer-based contributions for retirement, you may have an option to split your. 8 ways to save money quickly · 1. Change bank accounts. · 2. Be strategic with your eating habits. · 3. Change up your insurance. · 4. Ask for a raise—or start job.

In this article, we'll look at five money-saving hacks you can start implementing today to support your financial goals. It's important to save for your future—no matter how young or old you are. Why? Pension plans are rare. Social Security probably won't provide all the money a. One option is to open a checking account at a bank or credit union where your money will be protected and insured. Another way to save automatically is through your employer. In addition to employer-based contributions for retirement, you may have an option to split your. 8 ways to save money quickly · 1. Change bank accounts. · 2. Be strategic with your eating habits. · 3. Change up your insurance. · 4. Ask for a raise—or start job. In this article, we'll look at five money-saving hacks you can start implementing today to support your financial goals. Start a "Club" Savings Plan: Start a structured savings plan to save money over the course of a year for holiday or vacation expenses. Some banks and many. That means each pay period, before you are tempted to spend money, commit to putting some in a savings account. See if you can arrange with your bank to. When someone asks how much money they should save each month, I throw them a curveball reply: "What are your savings goals"? · At least 20% of your income should. 14 ways to save money · Set specific savings goals · Create a monthly budget and stick to it · Bring a shopping list to the store · Try using cash for everyday. 10 Money Saving Tips · 1. Track your spending. · 2. Establish a budget. · 3. Set up savings goals. · 4. Use an automated tool. · 5. Prepare for grocery shopping in. Savings Account: A savings account is a safe and easy way to save for a short period of time. It offers a low but income-generating return. We're here to help you build greater confidence in your ability to save and show you the best ways to set enough aside to reach your long-term. Putting money in a high-yield savings account can help you pay for unexpected expenses, such as medical bills, or weather unexpected events like losing your job. A common guideline is the 50/30/20 rule, where 50% of your income is put aside for your needs, 30% for your wants, and 20% for savings and investments. You can keep your money in a checking account, savings account, money market account, money market account, or bond, among many other low-risk investment. Deposit a portion of your income in a savings or retirement account. Don't accumulate new debt, and pay off any debt you currently have. We've created this guide for saving money, which includes big-picture detail-oriented tips for meeting your short-term and long-term savings goals. Use the tools below to set your financial goals and calculate how much money a month you need to set aside to make your goals and adventures happen! 20 tips for maximizing savings · 1. Create a budget plan · 2. Set savings goals · 3. Try a roundup program · 4. Turn saving into a game · 5. Cut down on some of your.

Using An Hsa As A Retirement Account

You'll still pay income tax, which is similar to how a traditional IRA works when withdrawing money. Using your HSA funds for medical expenses after age 65 will. Your employer can make pre-tax contributions to your HSA. You can also choose to contribute tax-free dollars through your payroll. Any others who choose to. A health savings account (HSA) is a great tool to help you prepare for future health care costs and retirement. Plus, it can help you save on taxes. If you don't use all the money in your health savings account (HSA) to pay for qualified medical expenses before, you can use the funds during retirement. 8. Can I use my HSA in retirement? Yes. Starting an account now while you're in good health could help you in retirement — when your medical bills are likely. Control—Owning an HSA lets you decide how to save and pay for QMEs. You can even use it to help cover your health plan deductible and out-of-pocket medical. Your HSA comes with what we call a triple tax advantage. Contributions, interest, any investment gains, and withdrawals for qualified health care expenses. Federal employees who are enrolled in HDHPs can make pre–tax allotments to their HSAs through their payroll provider or through their health plan's HSA trustee. Your HSA stays with you if you change jobs, retire or are no longer covered by a high-deductible health plan. After age 65, funds in an HSA can be used for non. You'll still pay income tax, which is similar to how a traditional IRA works when withdrawing money. Using your HSA funds for medical expenses after age 65 will. Your employer can make pre-tax contributions to your HSA. You can also choose to contribute tax-free dollars through your payroll. Any others who choose to. A health savings account (HSA) is a great tool to help you prepare for future health care costs and retirement. Plus, it can help you save on taxes. If you don't use all the money in your health savings account (HSA) to pay for qualified medical expenses before, you can use the funds during retirement. 8. Can I use my HSA in retirement? Yes. Starting an account now while you're in good health could help you in retirement — when your medical bills are likely. Control—Owning an HSA lets you decide how to save and pay for QMEs. You can even use it to help cover your health plan deductible and out-of-pocket medical. Your HSA comes with what we call a triple tax advantage. Contributions, interest, any investment gains, and withdrawals for qualified health care expenses. Federal employees who are enrolled in HDHPs can make pre–tax allotments to their HSAs through their payroll provider or through their health plan's HSA trustee. Your HSA stays with you if you change jobs, retire or are no longer covered by a high-deductible health plan. After age 65, funds in an HSA can be used for non.

To contribute to an HSA, you must participate in an eligible high-deductible health care plan—often, but not always, offered through an employer. For an. Additionally, any earnings and interest you earn in the account are not subject to taxes, meaning that you can use your HSA funds to grow your retirement. Many people make the mistake of using their HSA as a short-term savings account for current medical expenses. While this approach can provide some benefits, it. You may be able to claim a tax deduction for contributions you, or someone other than your employer, make to your HSA directly (not through payroll deductions). You can use your HSA for retirement income. Although you should use your HSA to cover medical expenses, you could use the funds as an additional source of. A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in an HSA to pay. The retiree can use an HSA to pay for current expenses or to save for future qualified medical and retiree healthcare expenses. To participate in an HSA, a. A retirement health savings (RHS) account is an employer-sponsored health savings retiree health care — through a tax-advantaged savings vehicle. Your RHS. For those who save diligently saved in HSAs and are now retirement age, creating a financial plan focused around using your HSA and other retirement accounts in. You decide how to use the HSA money, including whether to spend it now or save it to cover medical expenses in retirement (subject to minimum balance. While you aren't allowed to contribute to an HSA once you've enrolled in Medicare, these accounts offer new benefits in retirement. In addition to using your. How HSA can be a tool for retirement savings. While (k)s, IRAs, and Roth (k)s and IRAs have strict eligibility and contribution rules that can affect how. Additionally, any earnings and interest you earn in the account are not subject to taxes, meaning that you can use your HSA funds to grow your retirement. Federal employees who are enrolled in HDHPs can make pre–tax allotments to their HSAs through their payroll provider or through their health plan's HSA trustee. After age 65,you can use HSA funds exactly like an IRA. Any non-medical purchases made will have the standard tax applied to them (just like a traditional. A qualified HSA trustee can be a bank, an insurance company, or anyone already approved by the IRS to be a trustee of individual retirement arrangements (IRAs). An HSA, or Health Savings Account, is a bank account you use to pay for qualified medical, pharmacy, dental and vision expenses. Introduced in as a tax-preferred way for working Americans to pay out-of-pocket health care costs, Health Savings Accounts (HSAs) are today gaining. Many HSAs offer the opportunity to invest in mutual funds and other securities, which can accelerate account balance growth. In fact, using an HSA to save for. While Both IRAs and HSAs grow tax deferred, HSAs convert into traditional IRAs at age 65, thereby losing their favorable “tax free At.