garmincustomerservice.site Learn

Learn

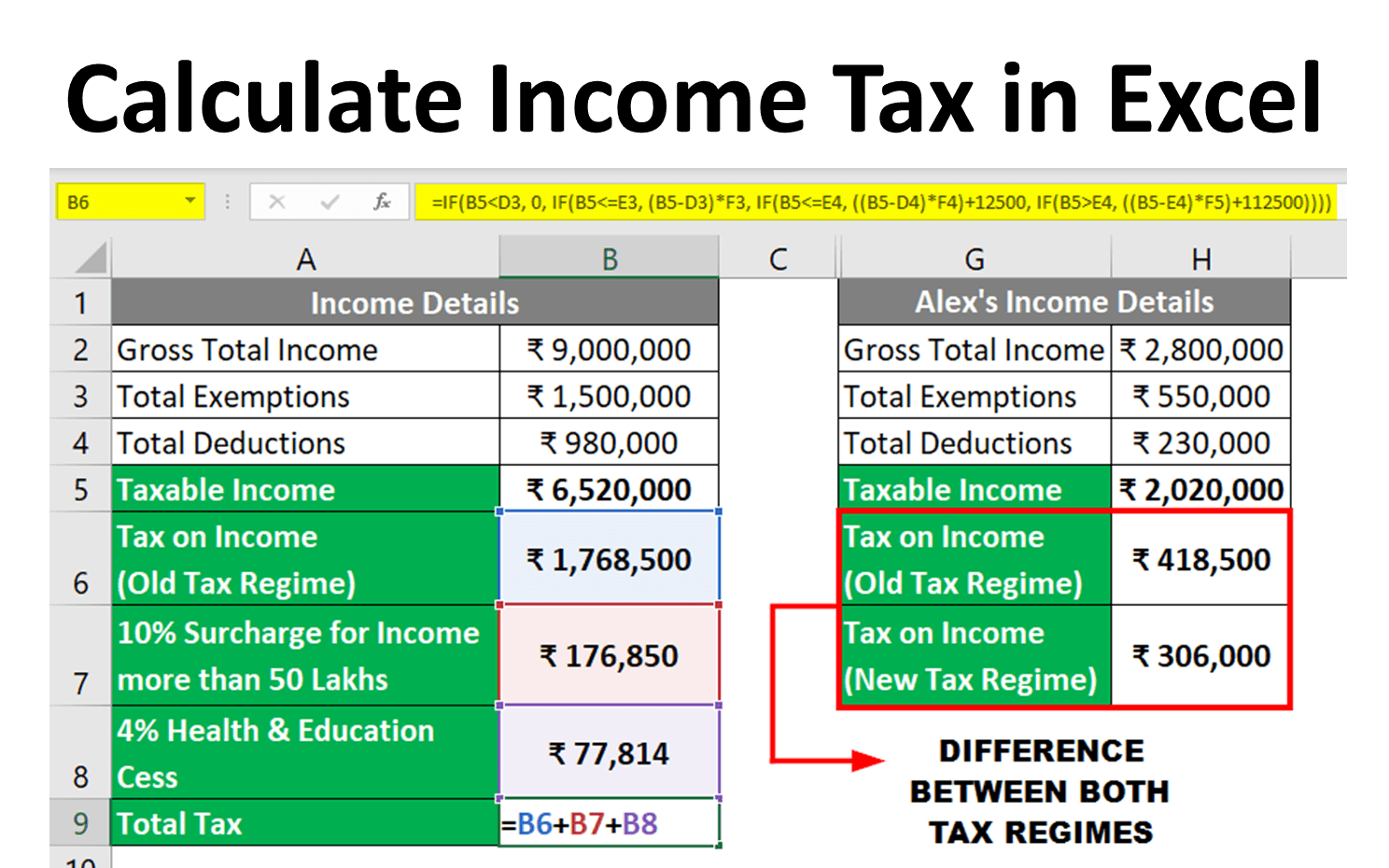

How To Calculate Tax On Income

Your total gross income is determined by adding up all types of income that you have received during the calendar/tax year. There are different lines on the. How to calculate income tax? (See example) Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Use our free income tax calculator to work out how much tax you should be paying in Australia. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. To calculate your effective tax rate, find your total tax on your income tax return and divide it by your taxable income. Your effective tax rate is a good. Use our Tax Calculator. Tax Bracket Calculator. Enter your tax year filing status and taxable income to calculate your estimated tax rate: What is my tax rate? 85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. Your total gross income is determined by adding up all types of income that you have received during the calendar/tax year. There are different lines on the. How to calculate income tax? (See example) Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Use our free income tax calculator to work out how much tax you should be paying in Australia. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. To calculate your effective tax rate, find your total tax on your income tax return and divide it by your taxable income. Your effective tax rate is a good. Use our Tax Calculator. Tax Bracket Calculator. Enter your tax year filing status and taxable income to calculate your estimated tax rate: What is my tax rate? 85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year.

It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of. Step 3a: In the Basic Calculator tab, enter the required details such as AY, taxpayer category, age, residential status, total annual income and total. Calculate AGI by adding all income and subtracting tax deductions. AGI can be zero or negative depending on your tax situation. What is adjusted gross income . income tax. RMC The information requested is necessary to determine your cash salary elements and estimate your marginal Federal tax bracket. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1, Free online income tax calculator to estimate U.S federal tax refund or owed amount for both salary earners and independent contractors. A tax calculator takes into account your income, expenses, and deductions to determine your tax liability. This is your Federal tax divided by your total income. The average tax rate is almost always lower, sometimes by a wide margin, than your income tax bracket or. For individual filers, calculating federal taxable income starts by taking all income minus “above the line” deductions and exemptions, like certain retirement. Curious to know how much taxes and other deductions will reduce your paycheck? Use our paycheck tax calculator. If you're an employee, generally your employer. Calculate your federal taxes with H&R Block's free income tax calculator tool. Answer a few, quick questions to estimate your tax refund. To determine their overall effective tax rate, individuals can add up their total tax burden and divide that by their taxable income. This calculation can be. In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. For instance, it is the form of income. Total income calculated by adding lines 7 through 21 on your form For most taxpayers this includes wages, salaries, tips, interest, dividends and gains. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. It can be described broadly as adjusted gross. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Federal income tax rates are progressive: As taxable income increases. Tax credit programs also reduce income tax liability for qualified applicants. Determining Residency · Child and Dependent Care Credit · Unpaid Court. Estimate your refund (taxes you file in ) with our income tax calculator by answering simple questions about your life and income. Your average tax rate is % and your marginal tax rate is %. This marginal tax rate means that your immediate additional income will be taxed at this.